A new report by blockchain data firm Chainalysis has revealed that NFT traders are selling their own pieces to themselves repeatedly to drive up the price. This practice, known as “wash trading”, is historically a market manipulation technique used in stock trading and has been made illegal since 1936 – unlike the unregulated NFT space.

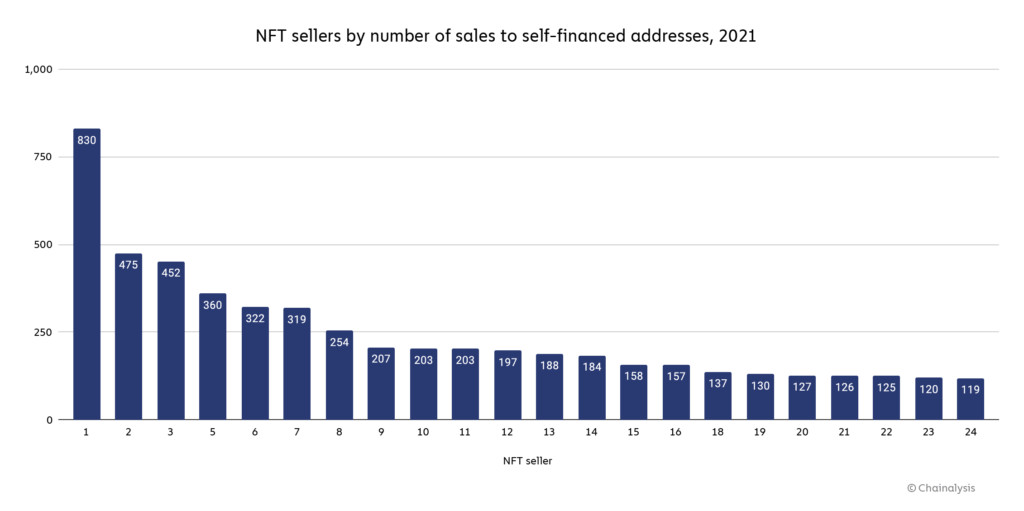

NFT wash trading is when a trader sells their digital art to another wallet that they control, giving the illusion that the collectible appears more valuable by artificially increasing its trading volume. The report identified 262 users who self-traded more than 25 times, though it clarified that it can’t be absolutely certain that all these accounts practiced wash trading.

The firm added that the most prolific wash trader made 830 sales to self-financed crypto wallets. However, calculations show that the trader had also made a loss due to gas fees, which are charged for each transaction. Overall, less than half of the traders in the analysis made a profit after accounting for the fees, with profitable users making almost US$8.9 million (~RM37.2 million).

The NFT marketplace grew exponentially last year, from US$106 million (~RM443 million) in 2020 to a staggering US$44.2 billion (~RM185 billion) in 2021. Because the digital tokens are not considered a security, they are not subject to laws that would otherwise prevent practices such as wash trading, plagiarism, and money laundering.

(Source: Chainalysis)

The post NFT Traders Are Reportedly Inflating Prices Through Wash Trading appeared first on Lowyat.NET.

0 Commentaires